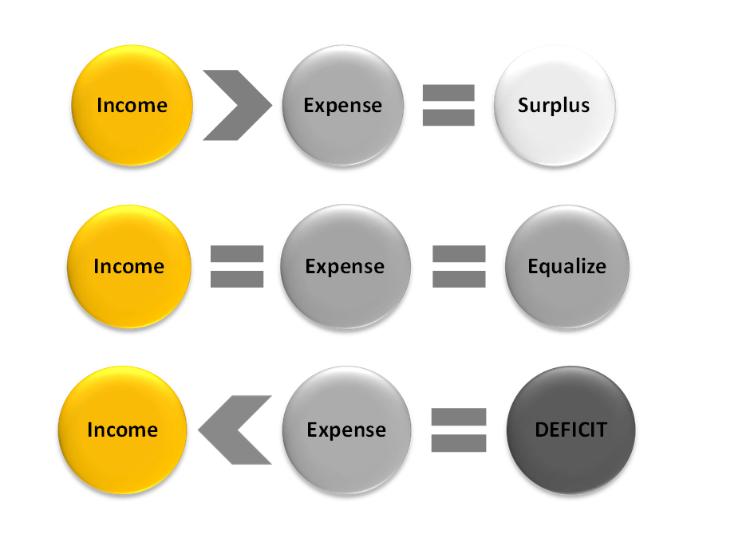

This typically refer to the review of financial aspects of an individual

This is the money or earnings that an individual receives, usually on a regular basis. There are various sources of income, including:

Employment Income: Salary or wages earned from a job.

Investment Income: Gains from investments such as dividends, interest, or capital gains from stocks and bonds.

Business Income: Money earned from operating a business or self-employment.

Rental Income: Income generated from renting out property or assets.

Passive Income: Earnings from sources that require minimal effort, like royalties, investments or rental income.

These are the costs incurred by an individual to maintain their lifestyle. They can be categorized into various types:

Fixed Expenses: Regular, predictable costs like rent or mortgage payments, insurance premiums, and loan repayments.

Variable Expenses: Costs that fluctuate, such as groceries, utilities, and entertainment.

Discretionary Expenses: Non-essential expenses like dining out, travel, and entertainment.

Operating Expenses: Costs associated with running a business, including rent, salaries, utilities, and office supplies.

Capital Expenses: Significant investments in assets, like purchasing machinery or real estate.

We help you take your personal finance to the next level. We educate you on how to assess your current financial situation. setting short-term and long-term financial goals and assisting with behavioural aspects of finance, such as overcoming financial challenges and developing healthy money habits.