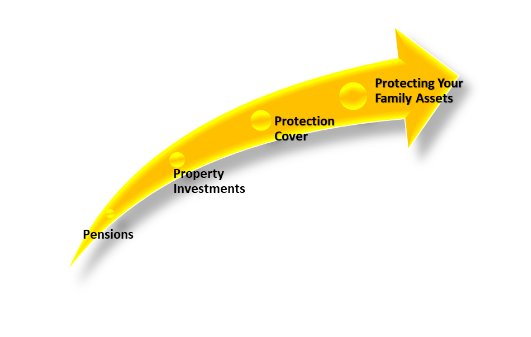

We look at your future finance and the prospects of it under Years Ahead section of D.E.P.L.O.Y. This includes Pension, Property Investments, Protection cover and Protecting your family assets.

Pension typically refers to a form of retirement income that is provided to individuals who have worked and contributed to a pension plan or government program during their working years. Here is some information related to pensions:

Types of Pensions:

Employer-Sponsored Pensions: Offered by employers to their employees as part of their benefits package.

State Pensions: Provided by the government to eligible individuals upon reaching the official retirement age. The specifics vary by country.

Personal or Private Pensions: Individuals can set up private pension plans, contributing money throughout their working years to secure income in retirement.

Property investment involves acquiring real estate with the expectation of generating income and or realising capital appreciation over time. Property investment requires careful research, financial analysis, and an understanding of the local real estate market. It is essential to consider factors such as location, property condition, potential for future development, and the overall economic environment. Additionally, managing tenants, property maintenance, and staying informed about market trends are crucial aspects of successful property investment. There are several ways to generate returns from property investment and to be successful, investing time, money and experience is required.

The circle of financial planning requires a comprehensive approach to managing one’s finances, encompassing various aspects to achieving overall financial well-being. One crucial element in this circle is protection cover, which typically refers to insurance products that help safeguard individuals and their families from financial risks. Insurance cover varies but it is important to ascertain what insurance cover is relevant to your need.

Types of Insurance

Life insurance policies can provide financial security for your family in the event of your passing. Term life insurance offers temporary coverage, while whole life insurance provides lifelong protection and an investment component.

Health insurance is a type of coverage that pays for medical expenses incurred by an individual. It helps in covering the costs of healthcare services such as doctor visits, hospital stays, prescription drugs, and preventive care.

Income Protection Insurance is a type of coverage that provides financial support to individuals in case they are unable to work due to illness, injury, or disability.

Protecting your family assets is a crucial consideration for many individuals. For example, Estate Planning includes drafting a will, establishing trusts, and naming beneficiaries.

An estate plan ensures that your assets are distributed according to your wishes and minimizes the impact of estate taxes. Remember that protecting family assets is a complex and individualized process. It’s essential to seek personalized advice from professionals who specialize in estate planning, financial planning, and asset protection to create a plan that suits your unique circumstances and goals.

To successfully invest in Property, great cashflow, equity growth and ability to refinance is our key expectation in property investment. We help you take your personal finance to the next level. We educate you, set short-term and long-term financial goals and assist with crucial aspects of your personal finance.